Let’s be honest—saving money feels impossible when you are living paycheck to paycheck.

You read about the famous “50/30/20 rule” everywhere. Financial experts love it. They tell you it’s the “simple” secret to wealth. They put it on colorful pie charts on Instagram. But when you sit down with your calculator, open your banking app, and try to apply it to your actual life, the math just doesn’t add up.

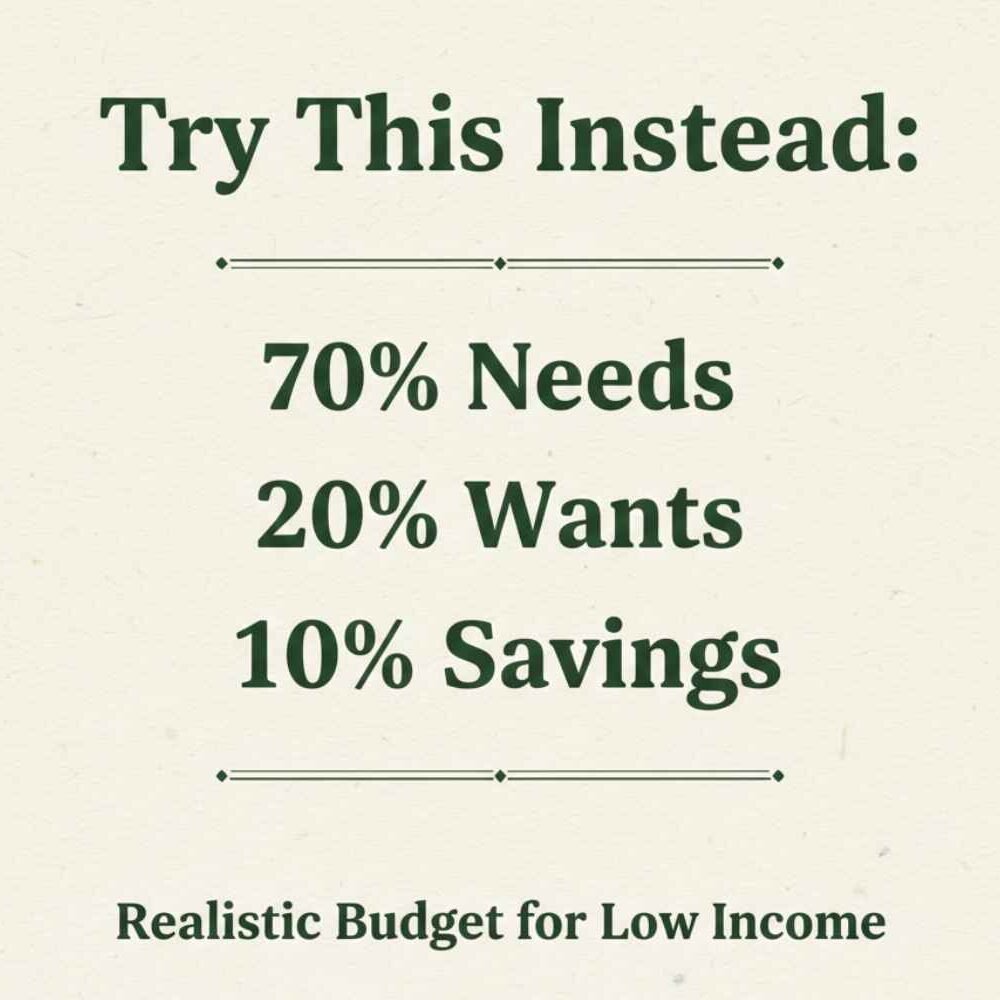

The 50/30/20 rule for low income is a modified budgeting strategy tailored for tight budgets. Unlike the traditional method, it adjusts spending to 70% for needs, 20% for wants, and 10% for savings, allowing low earners to cover rising living costs in 2026 without financial stress

How are you supposed to spend only 50% of your income on “needs” when your rent and groceries alone take up 70% of your check?

Does that mean you’re bad with money? Absolutely not. Does it mean you can never budget? No way.

The problem isn’t your math skills; the problem is trying to force a “rich person’s rule” into a “low-income reality.” If you are earning a low income, you don’t need the standard rule—you need a 50/30/20 rule for low income that actually respects your situation.

I see you. That panic of checking your balance before buying gas? I get it. And it is so frustrating to be told to ‘save more’ when you’re already buying generic brands and haven’t had a vacation in four years.

In this guide, I’m going to show you exactly how to tweak this popular budgeting method to fit a tight budget in 2026. We will break down realistic percentages, cut through the guilt, and finally help you get a handle on your money—even if you think you can’t.

The Traditional 50/30/20 Rule Explained.

Before we tear it apart and rebuild it for your life, let’s quickly look at what the original rule actually is.

Popularized by Senator Elizabeth Warren (back when rent was a lot cheaper), this method is designed to be a simple way to balance your money without complicated spreadsheets. It divides your after-tax income (what actually hits your bank account) into three buckets:

- 50% for Needs: Housing, utilities, groceries, insurance, minimum debt payments. These are the “keep the lights on” bills.

- 30% for Wants: Dining out, Netflix, hobbies, new clothes, and upgrading your phone. The fun stuff.

- 20% for Savings: Emergency fund, retirement, extra debt payments.

The Logic: The idea is that if you keep your “Needs” to half your income, you have plenty of breathing room for fun and savings.

The Reality: If you make $100,000 a year, this is easy. If you make $30,000? It’s a joke. Trying to squeeze a low income into these perfect boxes is like trying to fit a square peg into a round hole—it just breaks the peg.

Action Item: Don’t panic if your numbers don’t look like this. Almost no one with a low income fits into these boxes perfectly. We are going to fix that.

Why the 50/30/20 Rule Fails on Low Income (Real Talk)

Let’s get real for a second. If you’ve tried this rule and failed, it’s not because you lack discipline. It’s because the cost of living in 2026 is wild. Here is exactly why the standard 50/30/20 rule for low-income earners is often a trap.

1. The Rent is Too Damn High

Let’s do some math. Say you bring home $2,500 a month. According to the standard rule, your “Needs” (Rent + Utilities + Groceries + Car + Insurance) should only cost $1,250.

I don’t know where you live, but in most cities across the USA, $1,250 barely covers a studio apartment. Once you add in electricity ($100), phone ($60), insurance ($100), and food ($400), you are already way over that 50% limit. For many people, housing alone eats up 40% to 50% of their income.

2. “Wants” Are Often Just Sanity

When you have very little wiggle room, spending money on “Wants” feels guilty. But living with zero joy leads to burnout. The standard rule suggests you should have $750 for “fun” (30% of $2,500).

Realistically? You probably use that “fun money” just to cover the overflow from your “Needs” bucket. You aren’t buying designer bags; you’re buying better quality toilet paper or a pair of shoes because yours have holes in them.

3. The Savings Gap

Saving 20% of $2,500 means putting away $500 every single month. When you have credit card debt or a car that needs new brakes, that $500 usually gets eaten up before it ever hits your savings account.

When you see experts saying you must save 20%, it feels discouraging. It makes you feel as if you can’t save $500; you might as well save $0. And that is one of the biggest 50/30/20 rule low-income challenges.

Pull Quote: “The problem isn’t your math skills; the problem is trying to force a ‘rich person’s rule’ into a ‘low-income reality.'”

The Modified Rule That Actually Works

Okay, enough about why it doesn’t work. Let’s fix it.

We need to adjust the percentages to reflect realistic budgeting for low-income. The goal isn’t to hit a magic number; the goal is to stop bleeding money and start building stability.

Here are a few modified 50/30/20 rule variations that real people actually use. Pick the one that looks like your life.

The “Survival Mode” Split (70/20/10)

This is for you if you are really feeling the squeeze.

- 70% Needs: This acknowledges the reality that rent and food are expensive. It gives you permission to spend more on the basics without feeling like a failure.

- 20% Wants: You still need a little joy (Netflix, a cheap meal out, a hobby). If you cut this to zero, you will binge-spend later.

- 10% Savings: It’s not 20%, and that’s okay. Saving 10% is massive progress.

The “Debt Crusher” Split (60/10/30)

If you are drowning in debt but can live frugally (maybe you have a roommate or low rent).

- 60% Needs: Covers the basics.

- 10% Wants: You cut back heavily on fun for a short season. No eating out, free hobbies only.

- 30% Savings/Debt: You throw every extra dollar at your credit cards or loans.

The “Ultra-Lean” Split (80/10/10)

For when income is very low, or the cost of living is very high.

- 80% Needs: It is what it is. Rent, food, and lights.

- 10% Wants: Keep it cheap (library books, free parks, homemade coffee).

- 10% Savings: Building that emergency fund $20 at a time.

There are no “budget police” who will come arrest you if your needs are at 75%. The secret to budgeting on a low income is flexibility.

Pro Tip: Don’t get hung up on the exact numbers. A 71/19/10 split is fine too. The point is to have a plan, not a perfect pie chart.

Step-by-Step: Making It Work for YOUR Income

Ready to build a budget that doesn’t make you want to cry? Grab a pen (or your phone) and let’s do this. Here is your roadmap to using 50/30/20 alternatives effectively.

Step 1: Know Your “Real” Number

Not your salary. Not what you wish you made. Look at your bank account. What actually hit your account last month after taxes, insurance, and (401k) deductions? That is your Net Income.

- Example: You get paid every two weeks, $1,200 each paycheck. Your monthly income to budget is $2,400.

Step 2: List Your Non-Negotiables (The Four Walls)

Write down everything you must pay to survive. Be honest.

- Rent/Mortgage

- Utilities (Lights, Gas, Water, Phone)

- Groceries (Basic food, not steak dinners)

- Transportation (Gas, Bus pass, Car note)

- Minimum Debt Payments

Add it up. Is it $1,800? That’s 75% of your income. Guess what? You just found your modified percentage. Your rule isn’t 50/30/20. It starts with 75.

Step 3: Identify the “Wants” Trap

Now, list the rest. Streaming services, fast food, hobbies, subscriptions. If your Needs are 75%, you only have 25% left ($600) for everything else—Wants AND Savings.

This is where the hard choices happen. Can you live with just one streaming service instead of four? Can you cook at home 6 nights a week? This is where you find the money for your savings.

Step 4: The $500 Emergency Fund First

Before you worry about investing or big savings goals, just try to get $500 in a separate account. Why $500? Because tires go flat. Kids get sick. Phones break. This isn’t “wealth building” yet; it’s “disaster proofing.” Even if you can only save $25 a paycheck, do it.

Step 5: Automate the Tiny Amounts

If you decide you can save 5% (that’s $120 on a $2,400 income), set it up to move automatically the day you get paid. If you don’t see it, you won’t spend it. Treat your savings account like a bill that must be paid.

Step 6: Adjust as You Go

Your life changes. Your budget should, too. If you get a raise, don’t increase your spending. Keep your “Needs” expenses the same and dump that extra cash into your “Savings” bucket.

Action Item: Tonight, calculate your current “Needs” percentage. Just knowing that number gives you power.

Common Mistakes (And How to Avoid Them)

Even with budgeting percentages for low earners, it’s easy to mess up. Here are the traps I see people fall into all the time.

1. Confusing Needs with Wants

Real talk: A smartphone is a need in 2026. An iPhone 17 Pro Max with unlimited supreme data is a want. Home internet is a need. The fastest gigabit speed for gaming is a want. You have to be ruthless with this distinction if you want to find money to save.

2. Giving Up When You “Fail.”

So you blew your budget and ordered pizza on a Tuesday because you were exhausted. Most people say, “Well, I ruined it, might as well spend whatever I want for the rest of the month.” Don’t do that. That’s like slashing your other three tires because you got one flat. Just get back on track the next day. Perfection is the enemy of progress.

3. Forgetting “Irregular” Expenses

You budget for rent and food, but forget that Christmas happens every December. Or that your car registration is due in July. Or that your best friend is getting married. Solution: Start a “Sinking Fund.” Put aside $20 a month for these random bills so they don’t wreck your flow.

4. Comparing Yourself to Instagram

You see people “Cash Stuffing” thousands of dollars on TikTok. Remember: You don’t know their income. You don’t know if they live rent-free with their parents. Run your own race. Your $50 savings is a victory.

Warning: Be careful with “Buy Now, Pay Later” apps. They make “Wants” look affordable by breaking them into small payments, but they eat up your monthly cash flow fast.

Real Success Stories (What Actually Worked)

You aren’t the only one trying to solve this puzzle. Here is how real people apply 50/30/20 alternatives to their lives.

Scenario A: The Single Mom (Maria)

- Income: $3,200/month

- Her Struggle: Rent was $1,800 (56% of income).

- Her Fix: She accepted she couldn’t hit 50%. She used a 60/30/10 rule framework, but realized her “Wants” were too high because of convenience food for the kids. She started meal prepping on Sundays to cut food costs, bringing her needs down to 60%. She saves just $150 a month (approx 5%), but it’s consistent, and she has $1,000 in the bank for the first time.

Scenario B: The Gig Worker (Jason)

- Income: Fluctuates, averages $2,400/month

- His Struggle: Student loans were killing him.

- His Fix: He moved in with a roommate to slash rent. He uses a 50/10/40 rule—he lives extremely cheaply (only 10% wants, mostly free video games), so he can throw 40% at his debt to kill it fast. It’s not fun, but he knows it’s temporary until the debt is gone.

Tools & Resources to Help You Stay on Track

You don’t need a fancy accountant or expensive software. You just need the right tools to handle budgeting on a low income.

- Google Sheets / Excel: There are free modified 50/30/20 rule templates everywhere. Keep it simple. A notebook works too.

- Cash Envelopes (The Real Deal): If you swipe your card too much, switch to cash for your “Wants.” Take out $100 for the month for fun. When the cash is gone, the spending stops. No overdraft fees possible.

- Banking Apps: Most banks now let you create “Buckets” or “Vaults” inside your savings account. Label one “Emergency,” one “Car Repairs,” and one “Christmas.”

- Subscription Manager: Check your iPhone or Android subscription settings. You are probably paying for an app you haven’t opened in six months. Cancel it. That’s free money.

Action Item: Download your bank statements from the last 3 months. Highlight everything you bought that wasn’t a “Need.” It’s an eye-opening exercise.

Conclusion

Here is the bottom line: The 50/30/20 rule for low income isn’t broken—it just needs to be bent.

If you can’t hit the perfect 50/30/20 split, who cares? A 70/25/5 budget is infinitely better than no budget.

The goal is to take control. To look at your money and tell it where to go, instead of wondering where it went. It’s going to be tight. It might be messy. But you can do this. You are capable of managing your money, no matter how much or how little you make.

What to do now: Try it for just one month.

- Calculate your real percentages tonight.

- Adjust them to fit your reality (not Elizabeth Warren’s).

- Track your spending for 30 days.

You’ve got this. Now go make that money behave.

Frequently Asked Questions (FAQ)

Honestly? The traditional rule probably won’t work perfectly. Making under $30k means your “Needs” percentage will naturally be higher because rent and food don’t get cheaper just because you make less. However, the concept still works. You just need to modify it. Try the 70/20/10 split. The goal is to be aware of where your money is going, not to stress over hitting arbitrary numbers designed for wealthier people.

This is the most common issue in 2026. If your rent is 50%+, you have two choices: increase income or decrease expenses. Since moving isn’t always possible or cheaper, you have to cut from the “Wants” bucket. If rent is 55%, your Needs total might be 75%. That leaves you with 25% to split between Wants and Savings. You might have to run a 75/15/10 budget. It’s tight, but it keeps you safe.

Yes! A thousand times, yes. Saving 20% is a great goal, but saving 1% is better than saving 0%. If you can only save $20 a month right now, do that. The habit of saving is more important than the amount. As you pay off debt or get small raises, you can slowly increase that percentage. Don’t let the “ideal” stop you from doing the “possible.”

There is a gray area here. Food is a need, but DoorDash is a want. Clothes are a need, but brand-name sneakers are a want. A car is a need if you drive to work, but a brand new car with a $600 payment is a want. Rule of Thumb: If you can survive without it for a month, it’s probably a Want. If stripping it out causes you to lose your job or home, it’s a Need.

This is the classic debate. When you are low-income, I recommend a hybrid approach. First, save a small emergency fund ($500 to $1,000). You need this cushion so you don’t have to use credit cards when an emergency happens. Once you have that buffer, switch your focus to paying off high-interest debt (like credit cards). Stop saving heavily (just do the minimum) and attack the debt. Once debt is gone, go back to saving.

Yes, freelancers and gig workers can use this, but you need a “baseline.” Base your budget on your lowest-earning month from the last year. If you usually make between $2,000 and $3,000, build your budget on $2,000. If you have a good month and make $3,000, take that extra $1,000 and split it 50/30/20 (or put it all to savings)—never budget based on your “best” month.

You will feel a difference in the first month just by having clarity. You’ll sleep better knowing exactly how much you can spend. Financially, give it 90 days. The first month is messy. In the second month, you adjust. By the third month, you usually have a rhythm, your savings account has a little cash in it, and you feel in control. It’s a marathon, not a sprint.

You don’t need to pay for budgeting.

1. Goodbudget: Uses a digital envelope system (great for visual learners).

2. EveryDollar (Free Version): Very simple, zero-based budgeting tool.

3. Google Sheets: Fully customizable.

4. Pen and Paper: Seriously. Writing it down physically connects your brain to your money.